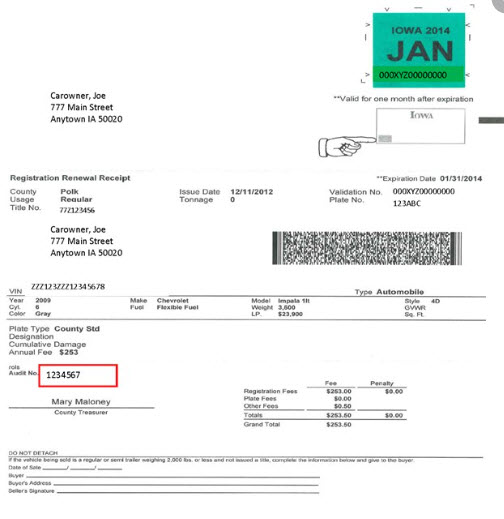

If you own a vehicle in Iowa, you must display a registration decal on your license plate and keep a registration receipt in the vehicle. If you’ve lost or damaged your items, it’s important that you replace them before you get a ticket.

Vehicle registration in Iowa must be done in person at your local treasurer's office. Bring your vehicle title, driver's license, an odometer statement, a damage disclosure statement (if applicable), and payment for your required fee. While some registrations pay standardized fees, others have weight- and price-based fees. Fee Estimator: This feature will estimate fees due for a newly acquired vehicle. You can calculate registration, title, security interest recording fees, and use tax. It will also calculate credit from a vehicle that has been sold, traded or junked. Truck Rate Calculator: This feature is used to determine registration fee by tonnage. Mar 10, 2020 Vehicle owners need to change car registration address in Iowa by performing a procedure through the IA DOT. Drivers may have several options for completing an address update and they may even use the same methods as for changing the address on a driver’s license or ID card.

Fortunately, Iowa’s Motor Vehicle Division has made the process of replacing your IA sticker or registration quick and easy.

IA Lost Registration & Plate Decals

Replacing a lost, stolen, or damaged registration or plate sticker is as simple as visiting your county treasurer’s office and requesting one. When you visit, make sure to be ready to provide your:

- Plate number.

- Current registration, if you are replacing your plate decal.

- Payment for the duplicate registration fee.

- This feeMAY VARYbased on your county of residence.FOR EXAMPLE, Polk County charges $3, but this may be different for you. Contact your county treasurer’s office for specific fee information.

Depending on your county’s requirements, you may also be asked to provide your:

- Vehicle’s year, make, and model.

- Driver’s license or ID card.

- Vehicle identification number (VIN). Find this on your:

- Title.

- Dashboard near the windshield on the driver’s side.

- Driver’s door jamb.

Please contact your local county treasurer’s office or the Iowa Motor Vehicle Division at (515) 237-3121 if you have any more questions about replacing your lost or damaged registration items.

Replacing Your License Plates in Iowa

If you've lost or damaged your vehicle's license plates, you can request replacement plates at your county treasurer's office. However, you will need to provide proof of your current vehicle registration and pay a fee for this service.

If you don't have your license plates or if your license plates are damaged beyond the point of being able to be read, you should not drive your car until you are able to obtain replacements.

All vehicles must be registered to legally be driven in Iowa. The annual registration fees are determined by Iowa Code sections 321.109 and 321.115 through 321.124 and are to be paid to the county treasurer’s office in the county of residence.

A summary of registration fees by vehicle type has been provided below:

Ambulance- Motor vehicle equipped with life support systems used for transporting sick or injured persons needing medical care to medical facilities.

$50

Antique Vehicles- Motor vehicle 25 years old or older

Purchased/Transferred on or after January 1, 2009:

- Standard minimum fee for the vehicle type applies

Grandfather Clause – Titled/Registered prior to January 1, 2009

- Model Year 1970-1983 - $23

- Model Year 1969 & older - $16

Autocycle- An autocycle is a three-wheeled vehicle that has a steering wheel and seating that does not require the operator to straddle or sit astride. These vehicles typically have bucket seats, seat belts, a steering wheel, and gas and brake pedals similar to a car.

Model Years Old | Fee |

1 - 5 | $20 |

6 or older | $10 |

Buses- Excluding church, private school and transit bus

Fee is formulated based on gross weight of empty vehicle plus 150 pounds multiplied by the number of passenger seats in the vehicle.

Church Bus

$25

Private-School Bus

No Fee – Plates Issued at State Level

Transit Bus

No Fee – Plates Issued at State Level

Electric Vehicles - Fee is based on weight and list price of the vehicle. Beginning with January 2020 renewals, an additional supplemental registration fee will be imposed on Battery Electric and Plug-in Hybrid Electric vehicles as required by the Iowa Legislature, HF767. The purpose of the supplemental registration fee is to mitigate the impact of those vehicles generating little to no fuel tax used to fund Iowa roads. The supplemental registration fee will be phased in over three years beginning January 1, 2020.

The formula to calculate the registration fee for electric vehicles is as follows: $0.40 per hundred pounds of vehicle weight, plus a percentage of the vehicle list price (reduced for older model years), plus the supplemental registration fee (based on vehicle type and phased in period).

Registration Fee Based on List Price and Age of Vehicle

Model Years Old | Percent of List Price |

1 - 7 | 1.00 |

8 - 9 | 0.75 |

10 - 11 | 0.50 |

12 and after | $50 |

Supplemental Registration Fee for Passenger Electric Vehicles - phased in over three years beginning January 1, 2020

| Vehicle Type | January 2020 Fee | January 2021 Fee | January 2022 Fee |

| Battery Electric (BEV) | $65.00 | $97.50 | $130.00 |

| Plug-in Hybrid Electric (PHEV) | $32.50 | $48.75 | $65.00 |

Example - January 2022 Renewal of a 2019 Battery Electric Vehicle (BEV)

Weight: 4,000 X .40% = | $16 |

List Price: $35,500 X 1% = | $350 |

Supplemental Fee: Battery Electric Vehicle (BEV) = | $130 |

Annual Fee = | $496 |

Hearse

$50

Motor Homes

Class | Suggested Retail | Model Years Old | Fee |

Class A | $80,000 & over: | 1 - 5 | $400 |

6 & older | $300 | ||

$40,000 to $79,999: | 1 - 5 | $200 | |

6 & older | $150 | ||

$20,000 to $39,999: | 1 - 5 | $140 | |

6 & older | $105 | ||

Less than $20,000: | 1 - 5 | $120 | |

6 & older | $85 | ||

Class B (Van type vehicle) | 1 - 5 | $90 | |

6 & older | $65 | ||

Class C | 1 - 5 | $110 | |

6 & older | $80 |

Motorcycle

Model Years Old | Fee* |

1 - 5 | $20* |

6 or older | $10* |

* Beginning with January 2020 renewals, an additional supplemental registration fee will be imposed on Battery Electric and Plug-in Hybrid Electric Motorcycles as required by the Iowa Legislature, HF767. The purpose of the supplemental registration fee is to mitigate the impact of those vehicles generating little to no fuel tax used to fund Iowa roads. The supplemental registration fee will be phased in over a three year period as outlined in the following table:

Supplemental Registration Fee for Battery Electric (BEV) and Plug-in Electric (PHEV) Motorcycles - phased in over three years beginning January 1, 2020

| Vehicle Type | January 2020 Fee | January 2021 Fee | January 2022 Fee |

| Motorcycle (BEV or PHEV) | $4.50 | $6.75 | $9.00 |

Motorized Bicycle or Moped

$7

Motorsport/Recreational Vehicle

$400

Multipurpose Vehicle - 1992 and older models

$55 - Examples: Chevrolet Blazer, Ford Bronco, IHC Scout, AMC Jeep CJ, and Dodge Ram Charger.

$60 - Special Equipped

321.109 - A multipurpose vehicle that has permanently installed equipment manufactured for and necessary to assist a person with a disability, who is either the owner or a member of the owner's household, in entering and exiting the vehicle, or if the owner or a member of the owner's household uses a wheelchair as his/her only means of mobility, the annual registration fee is $60.

Passenger cars (excluding Battery Electric & Plug-in Hybrid Electric Vehicles), low speed vehicles, 1993 and newer multipurpose vehicles, & 2010 and newer model year trucks (10K or less)

(Pertains to all vehicles where the registration fees are based on weight and list price of the vehicle.)

The formula is calculated as follows: $0.40 per hundred pounds of vehicle weight, plus

Model Years Old | Percent of List Price |

1 - 7 | 1.00 |

8 - 9 | 0.75 |

10 - 11 | 0.50 |

12 and after | $50 |

Example: Weight: 3,000 pounds, list price: $18,500

3,000 X .40% = | $12 |

$18,500 X 1% = | $185 |

Annual Fee = | $197 |

Special Truck & Truck Tractor

Special Truck Fees Chart

Semi-Trailer (includes 5thwheel and goose-neck)- Some part of the weight of the semi-trailer and load rests upon the towing vehicle. Trailers more than 2,000 lbs.

$30

Regular Trailer - Less than 2,000 lbs.

$20

Travel Trailer- Designed as a place of human habitation for vacation or recreational purposes. Based on square footage of floor space rounded to nearest whole dollar.

Model Years Old | Fee |

1 - 6 | $ .30 per sq. ft. |

7 & older | 75% of original fee |

Regular Truck, Truck Tractor and Buses

Gross weight or combined gross weight of combination of vehicles. Certain motor trucks registered for 6 tons or less, towing trailers or semi trailers, not for hire, are exempt from registration for combined gross weight.

Business Trade Truck

A business trade truck is 2010 model year or newer and weighs 10k or less and owned by a Corp., LLC, or Partnership, or by a person who files a schedule C or schedule F form with IRS which is eligible for depreciation under the IRS Code.

Leased - Same above criteria except: The lessee is a Corp, LLC, or Partnership and the truck is used primarily for purposes of the business, or the lessee is a person who files a schedule C or F form with IRS and the truck is used primarily for purposes of the person's own business or farming operation.

Penalties, up to $2,250, apply for falsely registering a vehicle as a business-trade truck. The owner must self-certify on the title application and each renewal to maintain business-trade usage.

Clinton Iowa Auto Registration

I just used Iowa Tax And Tags to pay the annual fee for my car. I was very impressed with the new site. It has a very clean design and is easy to use.