- Salary Tds Calculation Sheet In Excel

- Tds Working Sheet In Excel

- How To Prepare Tds In Excel Sheet

- Tds Working Sheet In Excel Template

- Tds Working Sheet In Excel Format Ay 19-20

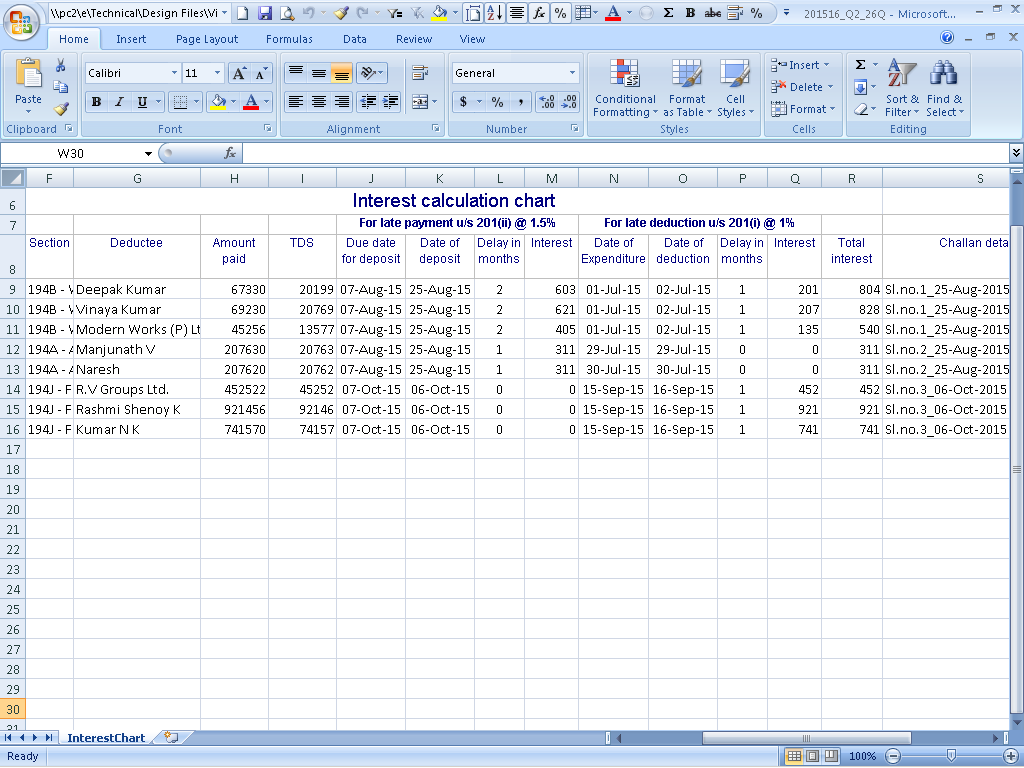

For TDS Calculation Sheet relevant for F.Y. 2017-18 and Asst.Year (A.Y.) 2018-19 Scroll to the End of this Post where you will find various links to download the Sheet using which you can Calculate TDS applicable. Or else to known the Latest Amendments for the person having salary income, Slab rates, importance of TDS and much more keep reading. Download Excel based Income Tax Calculator for FY 2020-21 & AY 2021-22/ Income Tax Calculator Excel Download. Planning for your income tax or calculating your income tax liabilities seems to be a very daunting task for many of us. If you believed in this myth, surely the Finance Budget 2020 would prove you wrong. Download TDS Calculator in Excel Format for Salary for Assessment Year 2019-20 (AY 2019-20 ) or Financial Year 2018-19 (FY 2018-2019 ) Also useful for computing Income Tax, Simple Excel Calculator. Know about How to Use the calculator by clicking the link of YouTube Video –. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators.

Finance Minister in her Budget 2020 speech mentioned that she has made the income tax structure simple. Unfortunately, this is far from truth. What has happened is the budget has given one more option to calculate your taxes. More option means more complexity.

We have come up with the income tax calculator incorporating both the existing system and new system of taxation. You can fill up the details and know which works best for you.

Contents

New Tax Regime

In case you want to opt for new tax regime, you will have to forgo most tax deductions and exemptions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc.

In most cases, with the new tax regime forgoing tax deductions, taxes work out to be higher.

Are you Paying Too much Taxes? Download your free presentation

Are you worried that you are paying too much in income tax? Are you aware of all the changes in the tax laws? Where should you invest to save taxes? Do you know all tax sections that you can use to save your tax. Download a concise 43 page presentation free to answer all the above questions and save your taxes – legally.

New Tax Regime – Tax Slabs

How much Taxes you Need to Pay this FY 2021-22? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Existing Tax Regime Tax Slabs

There has been no change in the tax slabs if you follow existing tax regime.

Download Income Tax Calculator

You can download the Income Tax Calculator for FY 2020-21 [AY 2021-22] from the link below.

Sukanya Samriddhi Account + PPF + SCSS Calculator

Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are part of small saving scheme sponsored by Government of India. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator – PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens’ Savings Scheme Calculator, NSC Calculator.

You can also download Income Tax Calculator for FY 2019-20, FY 2018-19, FY 2017-18, FY 2016-17, FY 2015-16, FY 2014-15, FY 2013-14, FY 2012-13 and FY 2011-12 by clicking on respective links.

Related posts:

Salary Tds Calculation Sheet In Excel

From India, Mumbai

Tds Working Sheet In Excel

From United States, Palo Alto

| Income Tax Calci (2).xls (28.0 KB, 218 views) |

How To Prepare Tds In Excel Sheet

Tds Working Sheet In Excel Template

If you are knowledgeable about any fact, resource or experience related to this topic - please add your views using the reply box below. For articles and copyrighted material please only cite the original source link. Each contribution will make this page a resource useful for everyone.